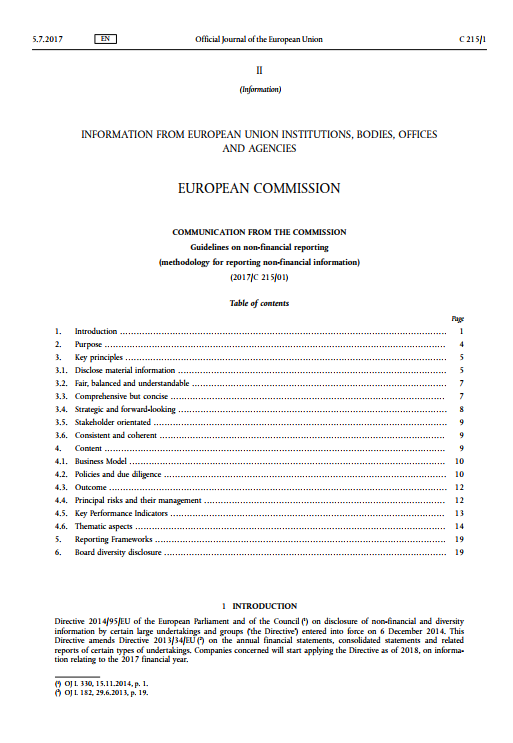

INTRODUCTION

Directive 2014/95/EU of the European Parliament and of the Council on disclosure of non-financial and diversity information by certain large undertakings and groups (‘the Directive’) entered into force on 6 December 2014. This Directive amends Directive 2013/34/EU on the annual financial statements, consolidated statements and related reports of certain types of undertakings. Companies concerned will start applying the Directive as of 2018, on information relating to the 2017 financial year.

Greater transparency is expected to make companies more resilient and perform better, both in financial and non-financial terms. Over time this will lead to more robust growth and employment and increased trust among stakeholders, including investors and consumers. Transparent business management is also consistent with longer-term investment.

The disclosure requirements for non-financial information apply to certain large companies with more than 500 employees, as the cost of obliging small and medium-sized enterprises to apply them could outweigh the benefits. This approach keeps administrative burden to a minimum. Companies are required to disclose relevant, useful information that is necessary to understand their development, performance, position and the impact of their activity, rather than an exhaustive, detailed report. Furthermore, disclosures may be provided at group level, rather than by each individual affiliate within a group. The Directive also gives companies significant flexibility to disclose relevant information in the way that they consider most useful, including in a separate report. Companies may rely on international, EU-based or national frameworks.

Appropriate non-financial disclosure is an essential element to enable sustainable finance. The European Commission decided on 28 October 2016 to establish a High Level Expert Group on sustainable finance. This builds on the Commission’s goal to develop an overarching and comprehensive EU strategy on sustainable finance as part of the Capital Markets Union. The group is expected to submit to the Commission a set of policy recommendations by end of 2017.

See the Guidelines online and in different languages here.